The process involves a comparison of Financial vs. Economic rate of return, Internal Rate of Return (IRR), Net Present Value (NPV), and Profitability Index (PI). Choosing the most profitable capital expenditure proposal is a key function of a company’s financial manager. The plans of a business to modernize or apply long-term investments will influence the cash budget in the current year. Throughput methods entail taking the revenue of a company and subtracting variable costs. This method results in analyzing how much profit is earned from each sale that can be attributable to fixed costs.

Methods

Long-term investments with higher profitability are undertaken which results in growth and wealth. Capital budgeting is a method of assessing the profitability and appraisal of business projects by comparing their Cash Flow with cost. These are subsequently sent to the budget committee to incorporate them into the capital budgeting. Follow-ups on capital expenditures include checks on the spending itself and the comparison of how close the estimates of cost and returns were to the actual values. For this reason, capital expenditure decisions must be anticipated in advance and integrated into the master budget.

Present value of an ordinary annuity

The ever-changing business environment can also affect capital budgeting decisions. Before taking on huge investments, business owners need to consider potential upcoming changes to labor regulations and the financial implications these might have. For instance, if there were changes to overtime payments for non-exempt vs exempt employees, there would be an impact on profits. The most important factor affecting decisions on capital budgeting is the level of risk.

What is your current financial priority?

Operational budgets are set for short-term purposes and are made for a period of one year, defined by the organization’s revenue and expenses. It takes into account revenue and expenses as well as depreciation. Many investments are long-term, so committing to a project is a decision that can affect sole proprietor the financial future of the company. Capital budgeting is crucial because it forces business leaders to make educated guesses about whether their significant investments will generate sufficient returns. Capital budgeting is a system of planning future Cash Flows from long-term investments.

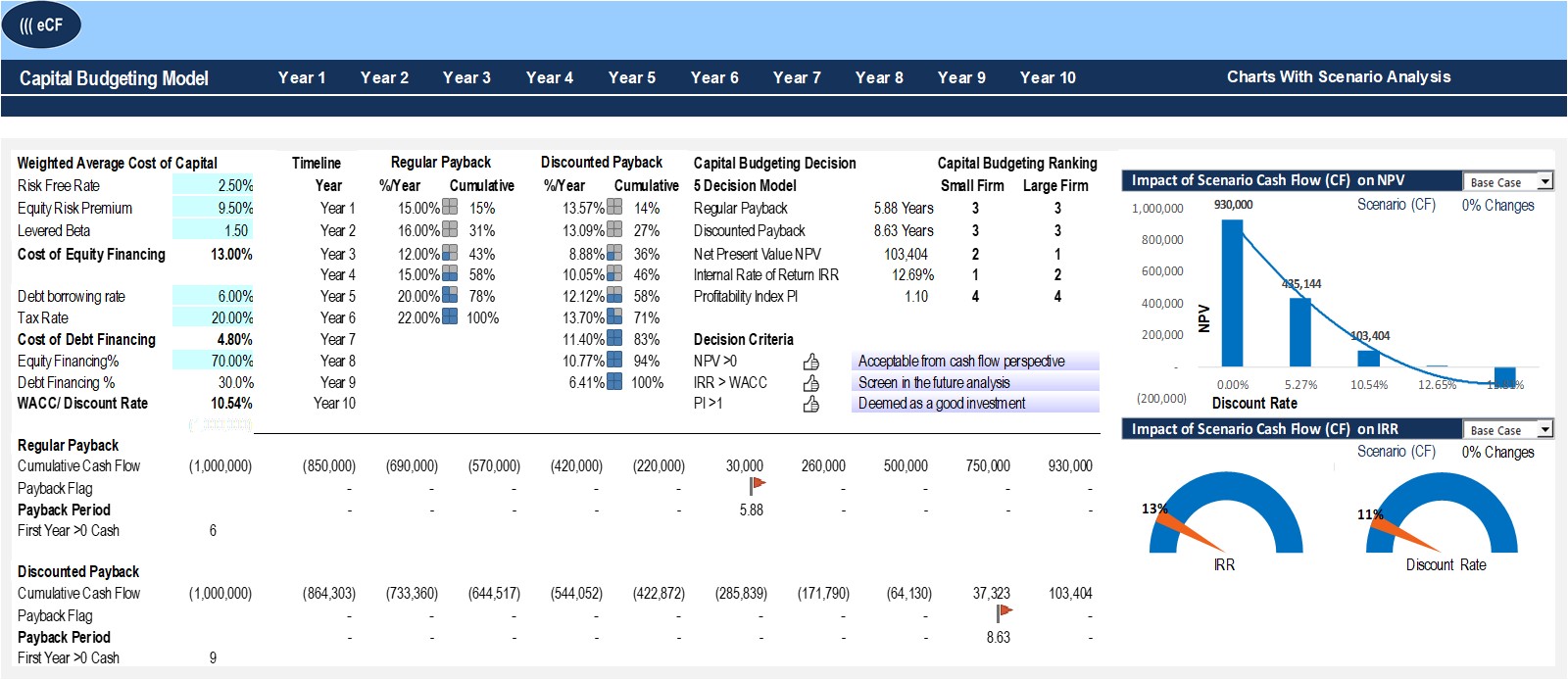

Businesses use various tools and software to assist their capital budgeting and financial planning. Many use existing accounting software to help track and manage projects and investments, while others stick to more conventional methods of spreadsheets. Payback analysis is the amount of time it takes to recover the cost of an investment.

- The alternatives being considered have already passed the test and have been shown to be advantageous.

- Decision-makers use this to analyze investments of equipment to expansions and takeovers.

- The capital budgeting process is a measurable way for businesses to determine the long-term economic and financial profitability of any investment project.

- A capital budget is a financial plan that outlines long-term investments in assets expected to generate future cash flows.

While one uses a percentage, the other is expressed as a dollar figure. While some prefer using IRR as a measure of capital budgeting, it does come with problems because it doesn’t take into account changing factors such as different discount rates. However, NPV also has limitations such as being unable to compare project sizes or requiring upfront rate estimations. The internal rate of return (IRR) estimates the profitability of potential investments using a percentage value rather than a dollar amount.

The primary objective of capital budgeting is to maximize shareholder value by making informed and strategic long-term investment decisions. The premium model requires maintenance service in year 2, year 4, and year 6 at a cost of $2,100 per service. This copier can be used to provide more services than the standard model so annual revenue is estimated to be $52,000 and annual cash operating expenses are estimated to be $21,000. In this case, if you add up the yearly inflows, you can easily identify in which year the investment and returns would close. So, the initial investment requirement for project B is met in the 4th year. There are two methods to calculate the payback period based on the cash inflows – which can be even or different.

IRR is the discount rate when the present value of the expected incremental cash inflows equals the project’s initial cost. Capital budgeting process is a necessary and critical process for a company to choose between projects from a long-term perspective. Therefore, it is necessary to follow before investing in any long-term project or business. Capital Budgeting refers to the planning process which is used for decision making of the long term investment. It helps in deciding whether the projects are fruitful for the business and will provide the required returns in the future years. Capital budgeting is used by businesses to analyze, prioritize, and evaluate investment in capital-intensive projects.